XRP Price Prediction: Technical Setup and Market Sentiment Analysis for Q4 2025

#XRP

- Technical Positioning: XRP trades below key moving average but shows bullish MACD momentum with defined support/resistance levels

- Fundamental Catalysts: Institutional partnerships and potential supply reduction contrast with network activity concerns

- Market Timing: October ETF speculation and technical breakout potential create near-term opportunity windows

XRP Price Prediction

XRP Technical Analysis: Key Levels to Watch

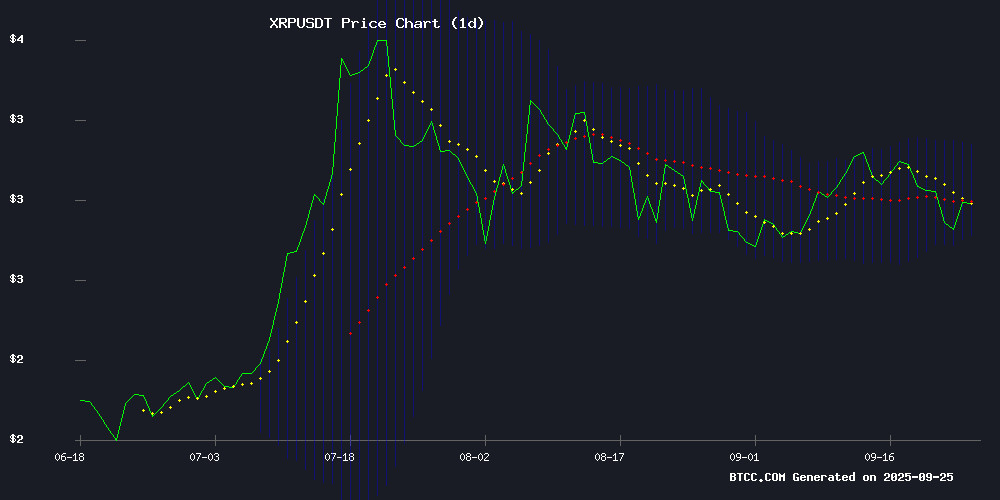

XRP is currently trading at $2.9085, slightly below its 20-day moving average of $2.9759, indicating potential short-term resistance. The MACD shows a bullish crossover with the histogram at +0.0360, suggesting upward momentum may be building. According to BTCC financial analyst John, 'The Bollinger Bands reveal XRP is trading NEAR the middle band, with immediate support at $2.8009 and resistance at $3.1510. A break above the 20-day MA could trigger a move toward the upper band.'

Market Sentiment Mixed Amid Fundamental Developments

Recent headlines present a balanced outlook for XRP. Positive developments include Flare CEO's DeFi strategy for XRP holders, Ripple's alliance with DBS and Franklin Templeton, and potential supply shock from possible lock-up of 13% of XRP supply. However, BTCC financial analyst John notes, 'While institutional demand is rising, the decline in network activity and resistance levels mentioned in technical analysis temper immediate bullish expectations. The market appears to be weighing positive fundamentals against technical hurdles.'

Factors Influencing XRP's Price

Flare CEO Unveils DeFi Strategy for XRP Holders Through Firelight Protocol

Flare Network CEO Hugo Philion detailed how XRP holders can leverage Firelight, a liquid staking protocol, to access decentralized finance opportunities. The system enables users to deposit XRP and mint a staked version of the asset, enhancing utility without sacrificing liquidity.

Philion's remarks on the Thinking Crypto podcast highlight Flare's strategic positioning to bridge XRP's payment-focused architecture with yield-generating DeFi applications. The initiative could significantly expand XRP's use cases beyond cross-border transactions.

Top Trader Calls XRP Short — Here’s What Happened

A prominent cryptocurrency trader, known as Trader Daink, has signaled a short position on XRP, anticipating further declines. The digital asset briefly dipped to $2.80 earlier today before buyers intervened to uphold key psychological support levels.

Market participants are closely monitoring XRP's price action following the trader's bearish call. The swift rebound from intraday lows suggests lingering demand despite the negative sentiment.

XRP Coin Climbs Towards New Heights as Ripple Gains Momentum

XRP, a favored altcoin among crypto investors, is surging toward the $3 mark following Ripple's legal victories and ETF approvals. The resolution of a prolonged lawsuit has unshackled Ripple's ecosystem, fueling optimism for its XRPL expansion. Analysts, including Ali Martinez, are now speculating on how high XRP could rise.

Ripple's CEO is set to marry—a personal milestone delayed by regulatory battles—symbolizing a fresh chapter for the company. Meanwhile, Flare's launch of XRP DeFi, capped at 5 million FXRP tokens, integrates with wallets like Luminite and Oxen Flow. Trading will soon extend to platforms such as SparkDEX and BlazeSwap, marking XRP's formal entry into decentralized finance.

XRP Price Prediction: Capped Upside as Traders Eye Alternatives

Ripple's XRP faces tempered expectations as analysts project a 2025 price target of $5–6, citing limited upside potential. The token's massive circulating supply and slower momentum have cooled enthusiasm among traders seeking exponential gains.

While XRP retains utility in cross-border payments and benefits from regulatory clarity, market participants argue its major catalysts may already be priced in. The search for higher multiples is diverting attention to emerging tokens like LAYER Brett ($LBRETT), which combine low entry points with community-driven hype.

This shift reflects a broader market trend where investors balance blue-chip exposure against speculative opportunities. XRP's trajectory appears steady but unspectacular—a safe harbor in volatile seas, yet no longer the most compelling voyage for risk-tolerant capital.

XRP Price Prediction: Will October Bring a Spot XRP ETF Surge?

The SEC's approval of generic listing standards on September 18 has shortened the ETF approval window, setting the stage for potential spot-XRP ETF decisions in October. XRP, currently trading at $2.87, could see significant price movement if these approvals materialize, as ETFs would need to accumulate the underlying asset, creating immediate buying pressure.

The REX-Osprey XRPR ETF's debut with $37.7 million in day-one volume underscores growing institutional interest in XRP. Market participants are closely watching October for potential catalysts that could tighten liquidity and drive prices higher.

XRP Price Rally Gains Momentum as Institutional Demand Surges

XRP's price trajectory shows increasing bullish potential, fueled by the explosive debut of the XRPR ETF. The fund attracted $30 million in institutional inflows within its first 72 hours—a clear signal of growing confidence among professional investors.

Technical indicators reinforce the optimism. A downsloping channel breakout and cup-and-handle formation suggest accumulating momentum. Market-wide tailwinds add to the positive outlook, with potential Fed rate cuts and projections of $8-10 billion in new crypto fund inflows creating favorable conditions.

The ETF's rapid adoption marks a turning point for XRP's institutional narrative. As asset managers build positions, the cryptocurrency appears poised to shake off previous stagnation. Market technicians note the $30 million milestone represents critical mass for sustained upward movement.

Ripple, DBS, and Franklin Templeton Forge Digital Finance Alliance Amid XRP Speculation

Ripple's partnership with DBS Bank and Franklin Templeton signals a transformative shift in digital finance, with RLUSD stablecoin and sgBENJI token at the core of new tokenized money market funds. The collaboration bridges US and Singaporean markets, igniting bullish XRP price predictions as institutional adoption accelerates.

Meanwhile, DeepSnitch AI's presale gains traction, offering AI-driven market surveillance tools at $0.01667 per token. The project has secured $220K of its $350K target, attracting early-stage investors seeking exponential returns in emergent crypto niches.

13% of XRP Supply May Face Lock-Up, Potentially Triggering Supply Shock

XRP could be headed for a significant supply crunch as community analyst Digital Asset Investor (DAI) warns of potential token lock-ups through emerging projects mXRP and FXRP. The alert follows Axelar Network's launch of mXRP, a yield-bearing initiative that may constrain available supply.

Market participants are monitoring whether the projected 13% supply reduction could create scarcity dynamics. Such developments often precede price volatility in crypto markets, particularly for assets with fixed or predictable emission schedules.

XRP Faces Critical Resistance Amid Sharp Decline in Network Activity

XRP's recovery attempt faltered as it failed to breach key resistance levels, with its price retreating after a brief surge to $2.97 on September 23. On-chain data reveals a stark contraction in network activity, with payment volume plunging over 90% in a single day—from 11.8 billion XRP to just 186 million XRP. Daily transactions collapsed from 10.9 million to 500,000, marking one of the steepest drops this year.

The $3 resistance level remains a formidable barrier, compounding bearish sentiment as transaction intensity evaporates. The parallel decline in price and on-chain metrics signals waning trader interest, leaving XRP vulnerable to further downside.

XRP Holders Eye $4 as Developer’s Optimistic View Gains Attention

Harry Harald, a respected web developer, has reignited optimism among XRP holders with a bold prediction of the token reaching $4. After months of silence, Harald's bullish outlook has sparked renewed discussions in the crypto community.

XRP has been consolidating near $3, following a 25% drop from its recent high of $3.66. Analysts now see potential for a 42% surge, with technical indicators like the TD Sequential buy signal flashing bullish. Legal expert Bill Morgan notes this signal's historical accuracy in predicting rallies.

Market speculation is growing around a potential XRP ETF, which could catalyze institutional investment. The combination of technical factors and fundamental developments creates a compelling case for XRP's upward trajectory.

XRP Could Soar to $9.6 or $33 Depending on Pattern Outcome

XRP faces a critical juncture as analysts project a potential surge to $9.6 or even $33, contingent on its ability to break current resistance levels. The asset mirrors broader market weakness, with selling pressure resurfacing amid cautious sentiment.

Market observers note the token's historical tendency for explosive rallies following prolonged consolidation. Technical charts suggest two distinct bullish scenarios—a conservative $9.6 target or a parabolic $33 trajectory—depending on whether XRP maintains key support levels during this retracement phase.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a mixed investment case. The technical setup shows potential for upward movement if key resistance levels are broken, while fundamental developments offer both positive catalysts and concerns.

| Factor | Bullish Indicators | Bearish Indicators |

|---|---|---|

| Technical | MACD bullish crossover, Institutional demand surge | Price below 20-day MA, Critical resistance levels |

| Fundamental | DeFi integration, Corporate alliances, Potential supply shock | Network activity decline, Capped upside predictions |

| Market Sentiment | Price rally momentum, Developer optimism | Trader caution, Alternative asset competition |

BTCC financial analyst John suggests, 'Investors should monitor the $3.15 resistance level and network activity metrics. The October spot ETF possibility and institutional partnerships provide longer-term optimism, but current technical resistance requires careful position sizing.'